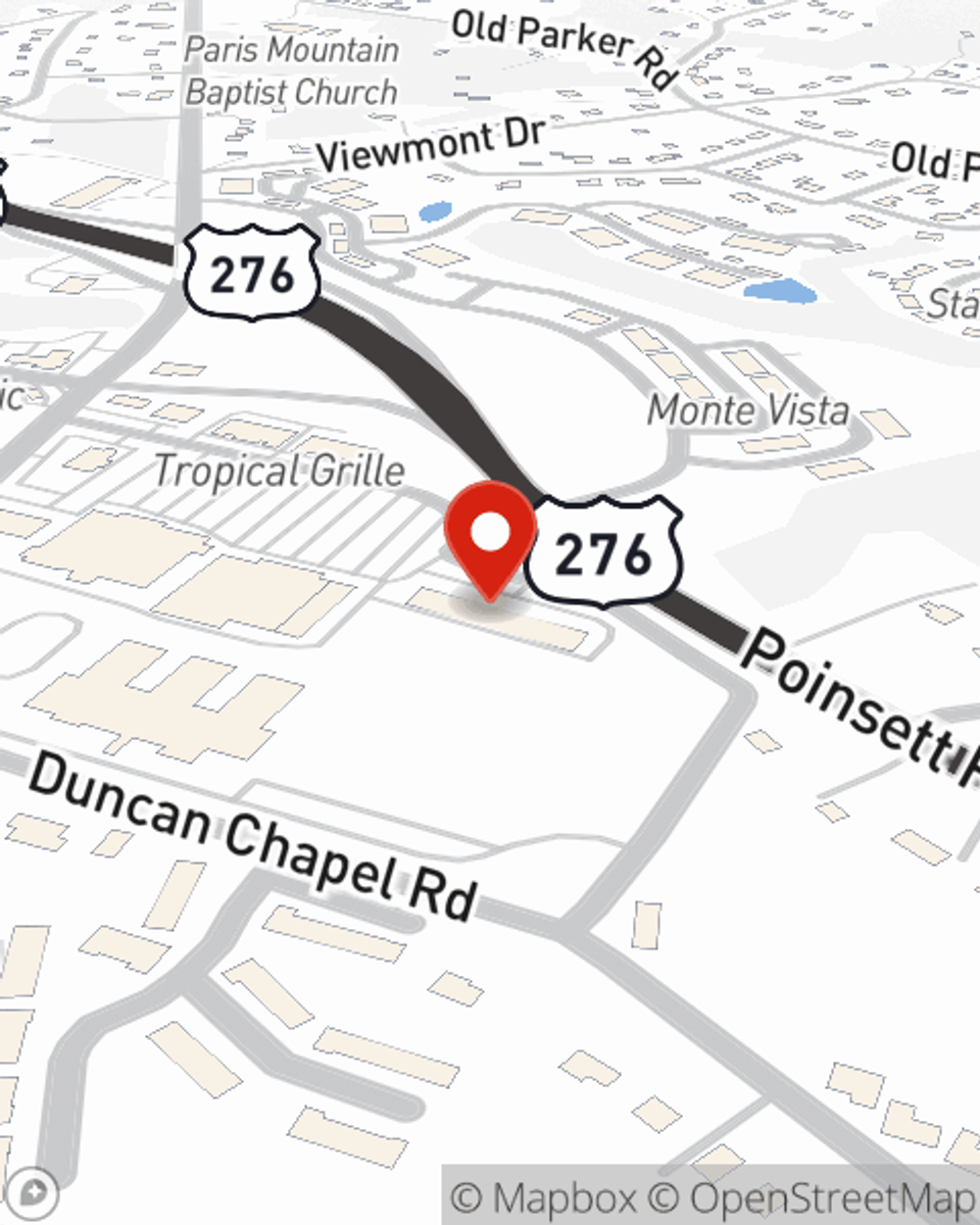

Homeowners Insurance in and around Greenville

Looking for homeowners insurance in Greenville?

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

Insure Your Home With State Farm's Homeowners Insurance

When you’ve worked a long shift, there’s nothing better than coming home. Home is where you rest, wind down and laugh and play. It’s where you build a life with your favorite people.

Looking for homeowners insurance in Greenville?

Apply for homeowners insurance with State Farm

Why Homeowners In Greenville Choose State Farm

Dylan Schaefer can walk you through the whole coverage process, step by step. You can have a no-nonsense experience to get coverage options for everything that’s meaningful to you. We’re talking about more than just protection for your appliances, furnishings and electronics. Protect your family keepsakes—like collectibles and souvenirs. Protect your hobbies and interests—like sports equipment and videogame systems. And Agent Dylan Schaefer can share more information about State Farm’s great savings and coverage options. There are savings if you have home security devices or choose a higher deductible, and there are plenty of policy inclusions, such as liability insurance to protect you from covered claims and legal suits.

Don’t let concerns about your home stress you out! Get in touch with State Farm Agent Dylan Schaefer today and see the advantages of State Farm homeowners insurance.

Have More Questions About Homeowners Insurance?

Call Dylan at (864) 246-2416 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What is an impact-resistant roof?

What is an impact-resistant roof?

Weather such as hail, high winds, snow and ice and even nearby wildfires can weaken or destroy your roof system. Impact-resistant shingles can help.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Dylan Schaefer

State Farm® Insurance AgentSimple Insights®

What is an impact-resistant roof?

What is an impact-resistant roof?

Weather such as hail, high winds, snow and ice and even nearby wildfires can weaken or destroy your roof system. Impact-resistant shingles can help.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.