Renters Insurance in and around Greenville

Get renters insurance in Greenville

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Trying to sift through deductibles and savings options on top of your pickleball league, family events and keeping up with friends, can be time consuming. But your belongings in your rented home may need the remarkable coverage that State Farm provides. So when the unexpected happens, your swing sets, furnishings and clothing have protection.

Get renters insurance in Greenville

Renting a home? Insure what you own.

Safeguard Your Personal Assets

You may be skeptical that Renters insurance can actually help protect you, but what many renters don't know is that your landlord's insurance generally only covers the structure of the space. How difficult it would be to replace your belongings can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when windstorms or tornadoes occur.

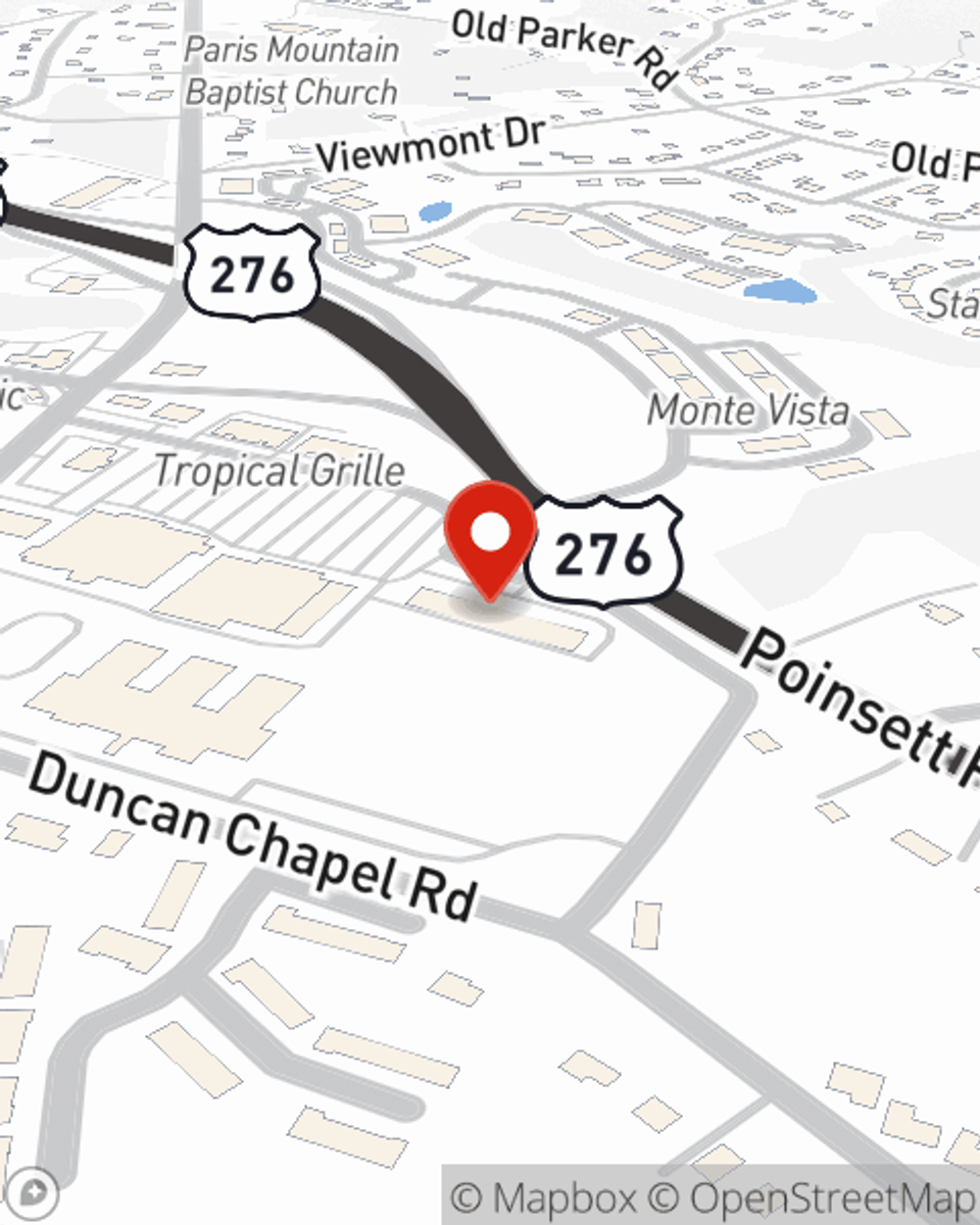

State Farm is a dependable provider of renters insurance in your neighborhood, Greenville. Get in touch with agent Dylan Schaefer today to learn more about coverage and savings!

Have More Questions About Renters Insurance?

Call Dylan at (864) 246-2416 or visit our FAQ page.

Simple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.

Dylan Schaefer

State Farm® Insurance AgentSimple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.